Venture Partners

Partner with us, change the world.

Join Us as a Venture Partner

Are you a connoisseur of groundbreaking technologies, with access to exceptional entrepreneurs and promising deals? Do you wish to transform your specialized knowledge into profitable investments in the next wave of technological innovation? If so, becoming a Venture Partner at Calculated Leap Ventures could be the opportunity you've been waiting for.

Your Role as a Venture Partner

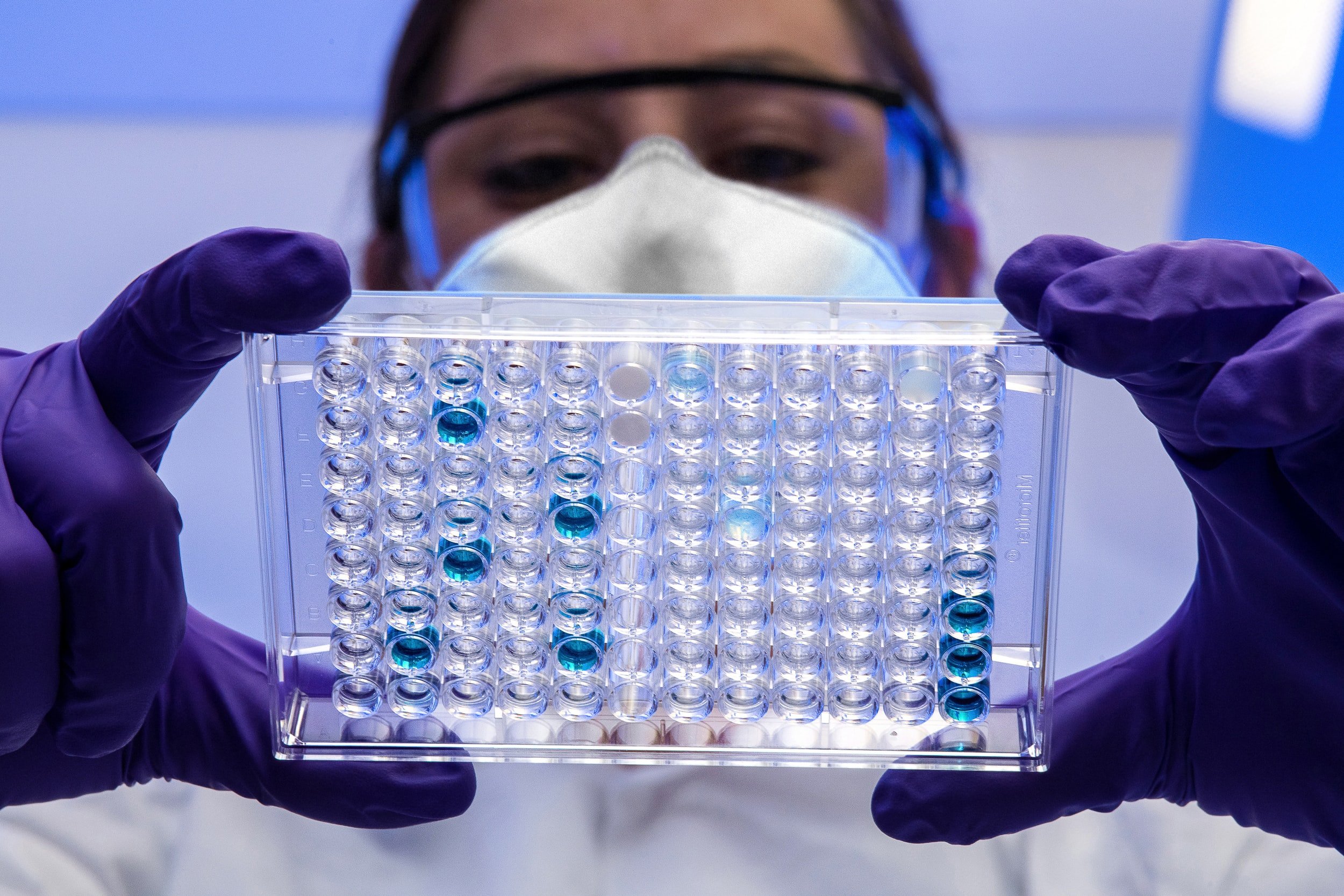

As a Venture Partner at Calculated Leap Ventures, you'll be at the vanguard of identifying and investing in the technologies that will reshape our world. Your mission will be to generate outsized returns for our Limited Partners (LPs) by discovering the most promising early-stage startups.

Venture Partners are integral to our operations. We rely on your entrepreneurial spirit, technical prowess, and expansive networks to spot and secure high-potential investment opportunities.

Benefit from Carried Interest

Every deal you broker as a Venture Partner comes with its rewards. You'll earn carried interest on each investment you bring into the Calculated Leap Ventures portfolio, providing a tangible appreciation of your efforts.

Leverage Our Proven Framework

We understand the complexity of early-stage investing, particularly in the deep-tech sector. That's why we equip our Venture Partners with the tools, methodologies, and support necessary to evaluate these startups effectively. Our expert partners will guide you in translating your domain expertise into insightful investment memos, ensuring a thorough and accurate assessment of potential investments.

Join us in our mission to shape the future of technology, one investment at a time.

FAQs

-

A great question, since this is how you will be compensated for your work and expertise. Carried Interest (also known as “carry”) is a share of the net proceeds of a deal. Here is a written description of carried interest by Investopedia, or if you like videos, here is a great video by Sean O’Sullivan, who breaks it down with an example and a great history lesson.

-

See our “About” page to learn more about the sorts of companies and entrepreneurs we are looking for.

-

Diversity is a strength, and we are excited about working with smart, passionate people, no matter their background. We typically look for someone with deep domain expertise who knows entrepreneurs operating in that domain’s early space.

Because we look at deep tech opportunities, this could be a person with a Ph.D. in engineering or science, or it could be someone who works at an accelerator or laboratory.

The key is that you have access to early-stage ventures, early on in their life-cycle.

-

We like AVC’s explanation, that it’s “a person who a VC firm brings on board to help them do investments and manage them, but is not a full and permanent member of the partnership.”